Vanguard University’s Department of Theater Arts Presents Award-Winning Fantasy PETER AND THE STARCATCHER

[ad_1]Vanguard University’s highly acclaimed and award-winning Department of Theater Arts presents Peter and the Starcatcher,…

[ad_1]Vanguard University’s highly acclaimed and award-winning Department of Theater Arts presents Peter and the Starcatcher,…

.jpg?h=26325c2e&itok=KX6Vt2sl)

[ad_1]SCHUYLKILL HAVEN, Pa. — Christina Talley is an entrepreneur and owner of a thriving performing…

[ad_1] 10 years of musical theater history! Feinstein/54 Below 10th Anniversary Celebration Since opening its…

[ad_1] A collaboration between science and art has brought dreams to life in this one-of-a-kind…

[ad_1]Find out what’s happening at the Shadbolt Center in April and May. Two innovative BC…

[ad_1] BY ALAN SHERROD IIn case you weren’t paying attention, jukebox musicals are real crowd…

[ad_1] Blinn College District’s Music and Theater Arts Programs invites incoming and prospective students to…

/cloudfront-us-east-1.images.arcpublishing.com/gray/3UCEE45ROJCMLI6DV4AZHVISNY.png)

[ad_1]COLLEGE STATION, Texas (KBTX) -They say life begins at 50, and now that MSC OPAS…

[ad_1] Photo credits: Mack Butler EAST GREENSBORO, NC (April 20, 2022) – North Carolina A&T…

[ad_1]WALDOBORO – The Waldo Theater (916 Main St.) currently operates a school program, InterAct, for…

Payday loans, which are quite popular now, are short-term loans offered by many financial companies.…

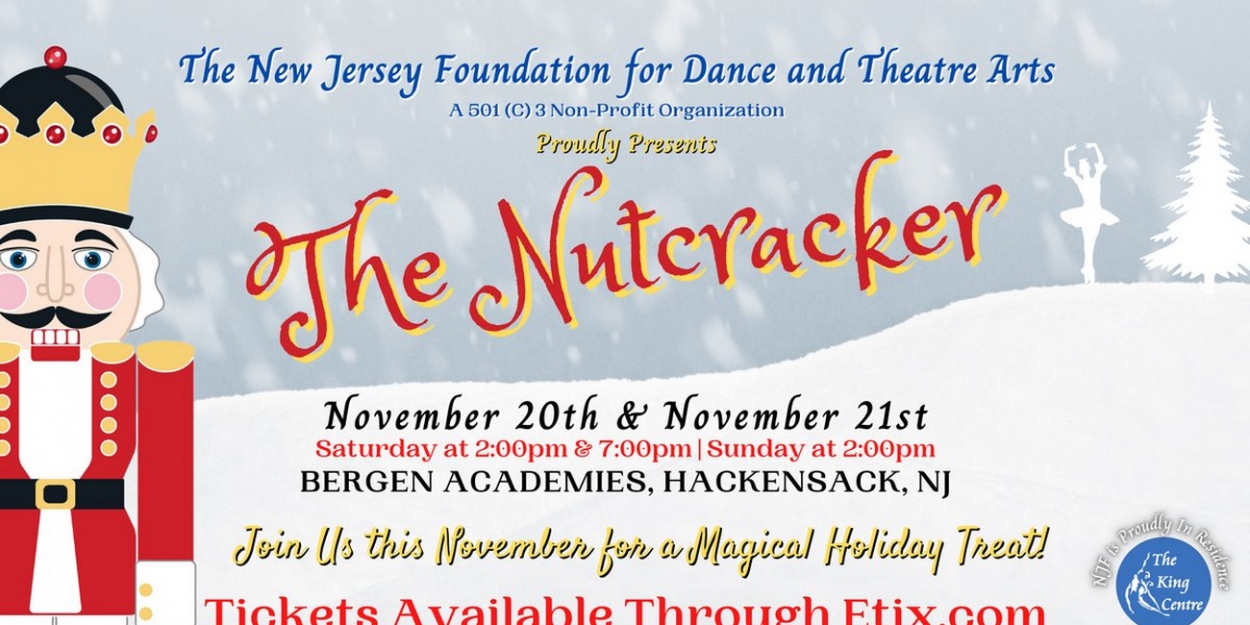

[ad_1]The New Jersey Foundation for the Dance and Dramatic Arts, a 501 (c) 3 nonprofit,…

[ad_1] Photo courtesy of Student Equity Advisory’s large Instagram page. During the summer of 2020,…

[ad_1] 1920 birthday of Nanette Fabray, Broadway Musical Star High buttoned shoes, Love life (Tony…

[ad_1]Sonoma State continues to face frequent budget cuts, which have sparked conflicts over program funding…

[ad_1] The Ministry of Culture applies all precautionary and preventive measures with daily sterilization of…

[ad_1] Andrea McArdle and Donna McKechnie, two of Broadway’s most endearing women, who have appeared…

[ad_1]Posted on June 2, 2016 | 5:40 p.m. A photo of “Simon Birch”, which will…